Please read Palm Prē:

Chronicle of a Death Foretold, Part 1.

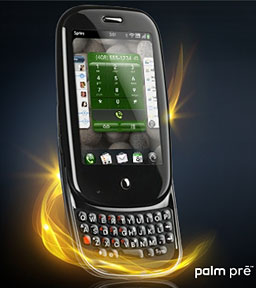

Winning markets is often a matter of timing. If the Palm Prē

had been available two years ago, the iPhone would have had serious

problems getting any traction. If the Prē had appeared 15 months

ago, it would have given the iPhone serious competition.

Now, after a successful launch, the Prē is looking at

challenging Windows Mobile and Android for 4th place in the smartphone

platforms market over the next 12 months. There is no way that the

Prē will take over from Apple (with 40 million+ iPhone/iPod touch

users), from RIM (with nearly 20% of the market and a strong lock on

corporate mobile email), or from Nokia (with nearly 40% of the market

and strong relationships with the non-US mobile phone companies).

Launch Problems

Clearly, Palm had problems getting the Prē out the door. No-one

in their right mind would launch two days before Apple's WWDC - but

maybe Roger McNamee made the decision. Maybe he believed his own words

in a March 5th interview: "You know the beautiful thing: June 29, 2009,

is the two-year anniversary of the first shipment of the iPhone; not

one of those people will still be using an iPhone a month later."

Reports from reviewers, such as Walt

Mossberg (WSJ) and

Jon Stokes (Ars Technica), show problems with software and early

hardware failures, but perhaps that was all designed to show off Palm's

impressive cloud backup so they could automatically download apps,

account information, and preferences again.

Prē's connection to iTunes looks like another shortcut to save

money. Apple doesn't need to sue over it. The support note shows that

Apple doesn't support the Prē. The "software fix" will be enough to

show users it just isn't safe to rely on Palm's hardware and software

skills, and

McNamee mouthing the M word at D7 won't protect them. Apple already

provides access to iTunes via XML - RIM and Nokia already use it.

Palm also had problems building

enough for launch. Most analysts estimate sales of around 50,000 for

the launch weekend. Stores selling out when they receive 20 or 30 units

and then not immediately restocked isn't impressive, especially when

you compare this "iPhone killer" to the 1 million sales of the iPhone

3G in it's first weekend or the estimated 500,000 of the original

iPhone.

Palm also had problems building

enough for launch. Most analysts estimate sales of around 50,000 for

the launch weekend. Stores selling out when they receive 20 or 30 units

and then not immediately restocked isn't impressive, especially when

you compare this "iPhone killer" to the 1 million sales of the iPhone

3G in it's first weekend or the estimated 500,000 of the original

iPhone.

Beleaguered Palm

This could well be a result of Palm's weak finances. While Palm may

be willing to commit to taking 50,000 units a week, suppliers will want

financial guarantees so they know they will be paid.

Last quarter, Palm burned through nearly $100 million and expected

to go through more this quarter, according to the 8-K filed on March 3.

This means little, if any, cash is likely to be left from the

successful share issue. In the 10-Q filed April 3, there was roughly

$230 million left in cash and cash equivalents, with $9 million of that

in Auction Rate Securities that are difficult to sell since the

collapse of that market. This will carry Palm through to Christmas at

best.

Unless the Prē is successful right away, Jon Rubinstein and his

team will need to raise more money to keep Palm going and to build the

market for the Prē. The problem is how.

Palm already carries $400 million in long term debt, and any new

long term debt will need to retire that. Elevation Partners is probably

still close to the limit it can invest and with other investments, like

that in Forbes, worth less than they paid, may not want to invest more.

Palm shares are up substantially from the $6 of the last sale, but a

share price around current levels, according to the analysis of Charles

Wolf of Needham & Co., needs sales of 8 million Pres to justify it

- and let's remember 8 million is more than iPhone sold in the first

year with no real competition and better distribution.

Hanging on to the $100 rebate will help Palm. If Palm manages to

sell 1 million Pres a quarter and the usual 40% of buyers fail to claim

their rebates, it will cut down on the cash Palm needs to raise.

Delaying the rebate checks will help too, so it could be interesting to

hear the excuses for any delays.

Of course, if Palm goes into bankruptcy, Prē buyers will be

lucky to see any rebate at all.

Prē Markets

Where will the Prē sell well, in the short term, so investors

will want to buy more shares? What niche markets can it take over? It's

already too late to hope to dominate the home or business markets.

McNamee may like to believe there is "white space" for Palm to move

into, but the more apps other platforms offer, the more those platforms

are likely to fill it. Until Palm can widely distribute the SDK for the

Prē, only a few developers will be able to write new apps to help

sales.

Palm also needs to put a microtransaction system in place to support

developers, unless they all want to write for free or are willing to

settle for less than the 70% share of revenue they get from the App

Store by selling through storefronts like Handango. Until good new apps

appear in quantity, the Prē is an expensive feature phone with

good browser and good messaging.

A Sprint Exclusive - for Now

Launching on Sprint, a CDMA network, at least protects the Prē

some from the iPhone competition. Apple won't move onto Verizon for at

least a couple of years. Sprint, though, as been losing customers every

quarter, as well as money, for some time, so it would have been better

for the Prē to launch on Verizon and, judging by recent remarks

about availability, maybe Verizon feels that way too.

Palm should, however, make it very public when Sprint's exclusivity

ends or customers who might otherwise buy Prē now will stay with

Verizon.

The Competition

The Prē has had much better reviews than the Blackberry Storm,

which has now sold over 1 million but needed strong marketing support

from Verizon/RIM to get there. Neither Sprint nor Palm have that kind

of money, so one of the big questions is how much publicity the

Prē will get in the aftermath of the iPhone 3G S launch. Palm

needs to get as much word of mouth as possible through Facebook groups,

geek gatherings, etc., or the Prē will be drowned by Verizon/RIM

Blackberry and Apple's iPhone marketing.

The short term rules out sales to any size of business that doesn't

already have a contract with Sprint. Also, businesses like to deal with

solid partners they know will be around, and they take their time to

evaluate new hardware and software. Significant business sales are

unlikely to start before 2010.

Geeks, Sprint Users, and Palm Users

The main short term markets look to be geeks who like to multitask,

satisfied Sprint users who want to upgrade to a smartphone, and

satisfied Palm users. Somehow, Palm needs to grab these markets and

reach at least a million Prē sales fast and then, if the SDK is in

good shape, more developers will come on board. Otherwise Prē

applications will fall further and further behind the iPhone (50,000),

Android (5,000), RIM (1,000), and third party applications are a major

attraction for smartphone users.

Palm Is No Apple

Palm is being talked about as though it will be another great

comeback story - another Apple brought back from near death. Anything

is possible before the last rites are read in bankruptcy court, but the

odds are much longer for Palm.

Apple had Steve Jobs and billions in the bank. It's major

competitor, Microsoft, was rightly concentrating it's efforts on taking

over the server market and defending itself against Netscape rather

than trying to add another 2 million or so desktop licenses a year.

Palm's main competitor is a lean and hungry Apple at the top of it's

marketing game, eager to take over the next big computer market and

occupy the position it should have won with the Mac. Other competitors

such as RIM, Nokia, and Android, are well financed and in a stronger

market position.

The End?

Palm had to bet the company, but it still looks like too little, too

late - and running out of cash to pay the wages and bills is what will

bring Palm down.

If WebOS is as good as it's supporters say, either the company will

be taken over or the assets will be bought out of bankruptcy court.

Palm shareholders will probably lose out unless there is a bidding war

between the likes of Nokia and Microsoft - and how likely is this when

the source code for WebOS is available under the GPL like any version

of Linux?

If the buyer has strong relationships with the carriers, Apple and

RIM will be up against a well financed competitor, but it will take

more than money to compete in what is becoming a two horse race.

Palm also had problems building

enough for launch. Most analysts estimate sales of around 50,000 for

the launch weekend. Stores selling out when they receive 20 or 30 units

and then not immediately restocked isn't impressive, especially when

you compare this "iPhone killer" to the 1 million sales of the iPhone

3G in it's first weekend or the estimated 500,000 of the original

iPhone.

Palm also had problems building

enough for launch. Most analysts estimate sales of around 50,000 for

the launch weekend. Stores selling out when they receive 20 or 30 units

and then not immediately restocked isn't impressive, especially when

you compare this "iPhone killer" to the 1 million sales of the iPhone

3G in it's first weekend or the estimated 500,000 of the original

iPhone.